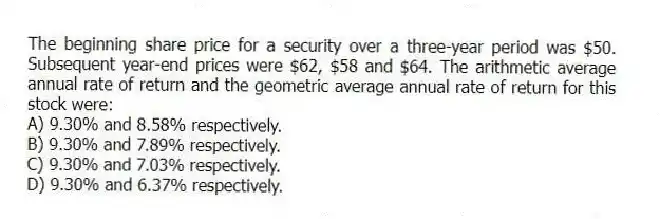

The beginning share price for a security over a three-year period was $50. Subsequent year-end prices were $62, $58 and $64. The arithmetic average annual rate of return and the geometric average annual rate of return for this stock were:

A) 9.30% and 8.58% respectively.

B) 9.30% and 7.89% respectively.

C) 9.30% and 7.03% respectively.

D) 9.30% and 6.37% respectively.

Correct Answer:

Verified

Q32: In some respects, internationally diversified portfolios are

Q33: An internationally diversified portfolio:

A) should result in

Q34: A U.S. investor makes an investment in

Q35: In general, the geometric mean will be

Q36: If a firm's expected returns are more

Q38: Instruction 13.1:

Use the information to answer the

Q39: When estimating an average corporate after-tax cost

Q40: Instruction 13.1:

Use the information to answer the

Q41: Which of the following is NOT a

Q42: Portfolio diversification can eliminate 100% of risk.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents