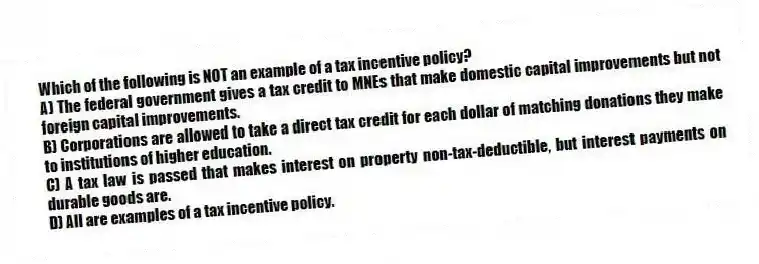

Which of the following is NOT an example of a tax incentive policy?

A) The federal government gives a tax credit to MNEs that make domestic capital improvements but not foreign capital improvements.

B) Corporations are allowed to take a direct tax credit for each dollar of matching donations they make to institutions of higher education.

C) A tax law is passed that makes interest on property non-tax-deductible, but interest payments on durable goods are.

D) All are examples of a tax incentive policy.

Correct Answer:

Verified

Q1: All indications are that the value-added tax

Q3: Toyota Motor Company operates in many different

Q4: Among the G7 nations, the U.S. has

Q5: The territorial approach to taxation policy is

Q6: A value-added tax has gained widespread usage

Q7: The United States taxes all earnings on

Q8: What is the total value of taxes

Q9: Which of the following is an unlikely

Q10: A _ tax policy is one that

Q11: In the mid-1980s, the U.S. led the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents