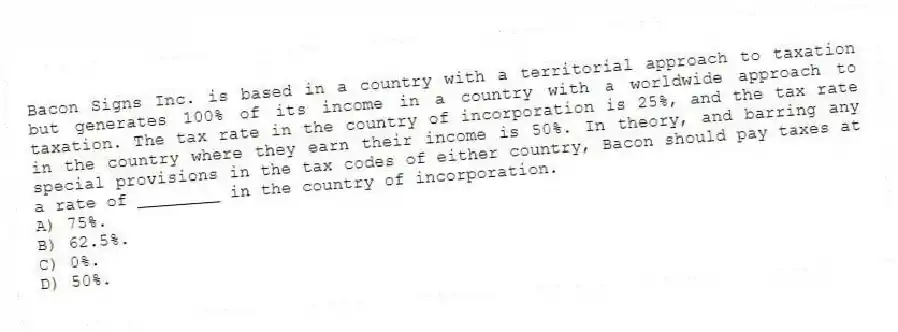

Bacon Signs Inc. is based in a country with a territorial approach to taxation but generates 100% of its income in a country with a worldwide approach to taxation. The tax rate in the country of incorporation is 25%, and the tax rate in the country where they earn their income is 50%. In theory, and barring any special provisions in the tax codes of either country, Bacon should pay taxes at a rate of ________ in the country of incorporation.

A) 75%.

B) 62.5%.

C) 0%.

D) 50%.

Correct Answer:

Verified

Q10: A _ tax policy is one that

Q11: In the mid-1980s, the U.S. led the

Q12: A tax that is effectively a sales

Q13: The issue of ethics in the reporting

Q14: Tax treaties generally have the effect of

Q16: A country CANNOT have both a territorial

Q17: The United States taxes the domestic and

Q19: Tax treaties typically result in _ between

Q20: A tax that is a form of

Q80: The primary objective of multinational tax planning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents