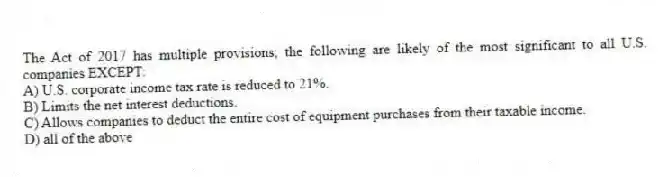

The Act of 2017 has multiple provisions; the following are likely of the most significant to all U.S. companies EXCEPT:

A) U.S. corporate income tax rate is reduced to 21%.

B) Limits the net interest deductions.

C) Allows companies to deduct the entire cost of equipment purchases from their taxable income.

D) all of the above

Correct Answer:

Verified

Q55: Governments worldwide compete for global investment on

Q56: Tax-haven subsidiaries are typically established in a

Q57: Why is it core to Google's tax

Q58: Why do the U.S. tax authorities tax

Q59: Of the following, which is NOT cited

Q60: Tax haven subsidiaries of MNEs are categorically

Q61: Tax analysts and authorities believe that in

Q62: In the context of the digital economy

Q63: As part of the Act of 2017,

Q65: All the OECD countries depend on individual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents