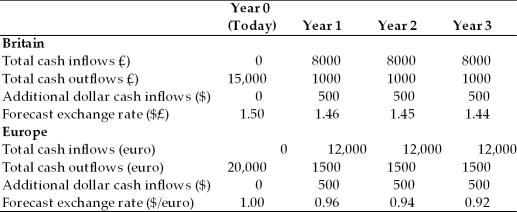

TABLE 19.1

Use the information to answer following question(s) .

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

-Refer to Table 19.1. The NPV for the British investment is estimated at ________.

A) $3,092

B) $6,420

C) £3,092

D) $0

Correct Answer:

Verified

Q5: The only proper way to estimate the

Q28: Which is NOT considered a shortcoming of

Q33: Benson Manufacturing has an after-tax cost of

Q37: Which of the following is NOT a

Q40: Capital budgeting analysis for a foreign project

Q41: Explain how political risk and exchange rate

Q42: Hydrotech Manufacturing of Houston Texas expects to

Q44: A Mexican firm wishes to build a

Q45: As in domestic capital budgeting, a potential

Q47: Project finance is characterized by which of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents