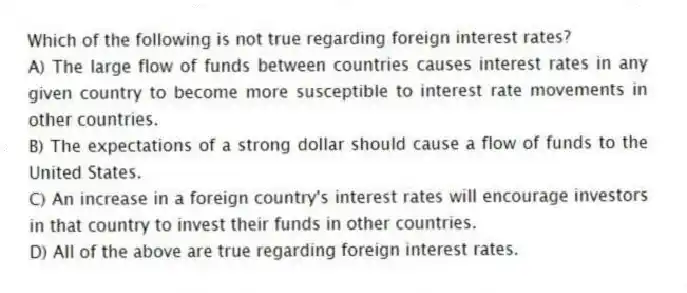

Which of the following is not true regarding foreign interest rates?

A) The large flow of funds between countries causes interest rates in any given country to become more susceptible to interest rate movements in other countries.

B) The expectations of a strong dollar should cause a flow of funds to the United States.

C) An increase in a foreign country's interest rates will encourage investors in that country to invest their funds in other countries.

D) All of the above are true regarding foreign interest rates.

Correct Answer:

Verified

Q22: If economic expansion is expected to decrease,

Q22: Which of the following will probably not

Q23: If the federal government reduces its budget

Q29: The federal government's _ determines the budget

Q30: Assume that foreign investors who have invested

Q34: Assume that foreign investors who have invested

Q35: If inflation turns out to be lower

Q36: If the federal government needs to borrow

Q39: The federal government's spending policies are generally

Q40: If the real interest rate is expected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents