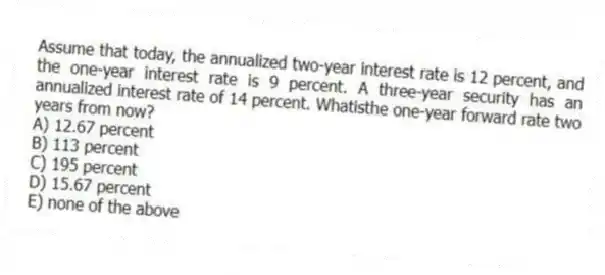

Assume that today, the annualized two-year interest rate is 12 percent, and the one-year interest rate is 9 percent. A three-year security has an annualized interest rate of 14 percent. Whatisthe one-year forward rate two years from now?

A) 12.67 percent

B) 113 percent

C) 195 percent

D) 15.67 percent

E) none of the above

Correct Answer:

Verified

Q23: If the liquidity premium exists, a flat

Q25: Other things being equal, the yield required

Q26: If a yield curve is upward sloping,

Q26: Assume that the Treasury bond yield today

Q27: If liquidity influences the yield curve, but

Q29: According to the pure expectations theory of

Q31: According to the liquidity premium theory, the

Q33: In some time periods, there is evidence

Q35: If research showed that anticipation about future

Q37: The theory of the term structure of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents