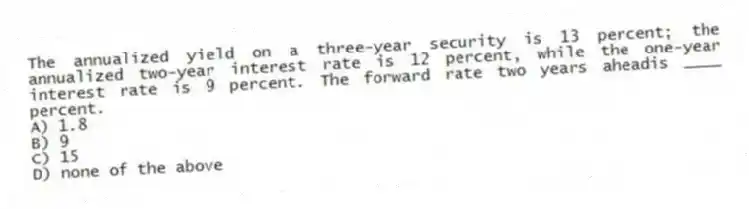

The annualized yield on a three-year security is 13 percent; the annualized two-year interest rate is 12 percent, while the one-year interest rate is 9 percent. The forward rate two years aheadis ____ percent.

A) 1.8

B) 9

C) 15

D) none of the above

Correct Answer:

Verified

Q42: According to segmented markets theory, if investors

Q43: The forward rate is commonly used to

Q46: Some types of debt securities always offer

Q48: Assume that debt maturity markets are segmented,

Q49: The preference for more liquid short-term securities

Q53: Investors will always prefer the purchase of

Q54: According to the segmented markets theory, the

Q55: The graphic comparison of maturities and annualized

Q56: The annualized yield on a three-year security

Q57: Other things being equal, an expected decrease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents