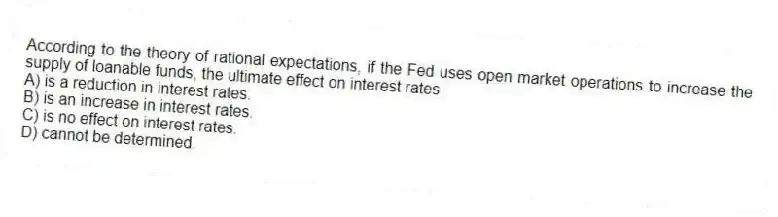

According to the theory of rational expectations, if the Fed uses open market operations to increase the supply of loanable funds, the ultimate effect on interest rates

A) is a reduction in interest rates.

B) is an increase in interest rates.

C) is no effect on interest rates.

D) cannot be determined.

Correct Answer:

Verified

Q22: The Federal Reserve would be most inclined

Q25: In recent years, the Fed has made

Q28: The Fed faces a trade-off in monetary

Q29: The relationship between the interest rate on

Q32: Global crowding out is described in the

Q33: When the Fed uses open market operations

Q34: The supply schedule of loanable funds indicates

Q34: During the 2008-2015 period, the Fed reduced

Q41: The Fed is more likely to use

Q44: Economists who work at the Fed recognize

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents