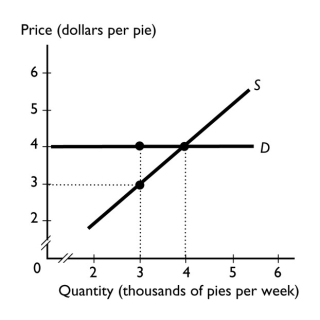

-The demand for apple pies is perfectly elastic.If the government taxes apple pies at $1 a pie,then ________.

A) the seller pays the entire tax

B) the buyer pays the entire tax

C) the seller and the buyer split the tax evenly

D) the seller and the buyer split the tax but the seller pays more

E) who pays the tax depends on whether the government imposes the tax on pie buyers or on pie sellers

Correct Answer:

Verified

Q56: Why do sellers pay all of a

Q57: When a tax is imposed on a

Q58: Suppose the elasticity of demand for a

Q59: Sellers bear the entire incidence of a

Q60: When a tax is imposed on a

Q62: Neither the supply of nor demand for

Q63: Suppose the elasticity of demand for Mexican

Q64: When a tax is imposed on a

Q65: The size of the deadweight loss,or excess

Q66: Neither the supply of nor demand for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents