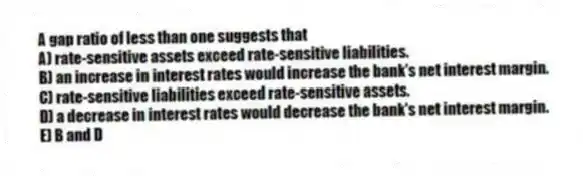

A gap ratio of less than one suggests that

A) rate-sensitive assets exceed rate-sensitive liabilities.

B) an increase in interest rates would increase the bank's net interest margin.

C) rate-sensitive liabilities exceed rate-sensitive assets.

D) a decrease in interest rates would decrease the bank's net interest margin.

E) B and D

Correct Answer:

Verified

Q15: For most banks, the average duration of

Q15: If a bank attempts to reduce exposure

Q18: The duration of zero-coupon bonds will be

Q18: Which of the following financial institutions would

Q19: Banks increase their risk by increasing their

Q21: Banks can reduce their credit risk by

Q22: If Bank A has a negative gap

Q23: International diversification of loans can best reduce

Q24: During a period of rising interest rates,

Q36: A bank's net interest margin is commonly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents