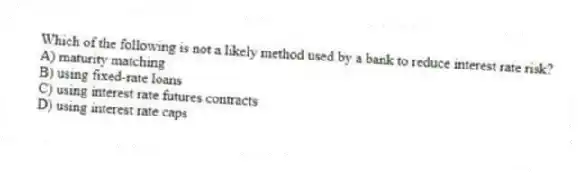

Which of the following is not a likely method used by a bank to reduce interest rate risk?

A) maturity matching

B) using fixed-rate loans

C) using interest rate futures contracts

D) using interest rate caps

Correct Answer:

Verified

Q5: If a bank expects interest rates to

Q7: As the secondary market for loans has

Q8: Other things being equal, assets with shorter

Q10: Other things being equal, assets with _

Q10: The _ of interest rate futures _

Q11: Each bank may have its own classification

Q11: Petri Bank had interest revenues of $70

Q12: During a period of rising interest rates,

Q13: Floating-rate loans cannot completely eliminate interest rate

Q20: Banks are more liquid as a result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents