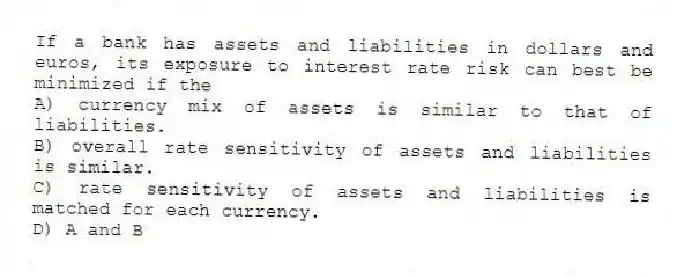

If a bank has assets and liabilities in dollars and euros, its exposure to interest rate risk can best be minimized if the

A) currency mix of assets is similar to that of liabilities.

B) overall rate sensitivity of assets and liabilities is similar.

C) rate sensitivity of assets and liabilities is matched for each currency.

D) A and B

Correct Answer:

Verified

Q43: Durango Bank has $2 million in rate-sensitive

Q44: The performance of a bank that continually

Q45: Macon Bank has interest revenues of $4

Q46: A positive gap (or gap ratio of

Q48: Floating-rate loans completely eliminate interest rate risk.

Q49: A bank can usually simultaneously maximize its

Q50: _ is (are)least likely to be used

Q50: The risk of a loss due to

Q52: Whether a bank has a temporary or

Q52: If the duration of all banks assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents