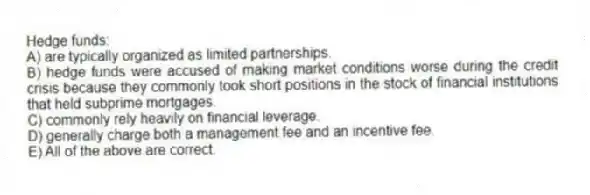

Hedge funds:

A) are typically organized as limited partnerships.

B) hedge funds were accused of making market conditions worse during the credit crisis because they commonly took short positions in the stock of financial institutions that held subprime mortgages.

C) commonly rely heavily on financial leverage.

D) generally charge both a management fee and an incentive fee.

E) All of the above are correct.

Correct Answer:

Verified

Q64: Equity REITs essentially represent fixed-income portfolios, so

Q65: Exchange-traded funds differ from open-end funds in

Q73: Based on the market value of total

Q74: A mutual fund's performance is usually unrelated

Q77: Equity REITs are sometimes purchased to hedge

Q79: Hedge funds try to obtain an information

Q80: The _ of a mutual fund represents

Q82: Which of the following statements is incorrect?

A)

Q83: Which of the following is not true

Q90: Shares of exchange-traded funds can be sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents