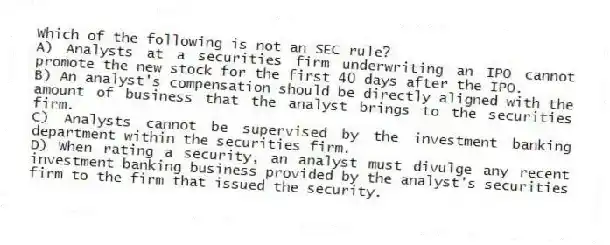

Which of the following is not an SEC rule?

A) Analysts at a securities firm underwriting an IPO cannot promote the new stock for the first 40 days after the IPO.

B) An analyst's compensation should be directly aligned with the amount of business that the analyst brings to the securities firm.

C) Analysts cannot be supervised by the investment banking department within the securities firm.

D) When rating a security, an analyst must divulge any recent investment banking business provided by the analyst's securities firm to the firm that issued the security.

Correct Answer:

Verified

Q1: The _ determines margin requirements on securities

Q6: The one-day return to investors who purchase

Q9: In a _ of stock, all of

Q10: Which of the following is not a

Q11: The _ regulates the issuance of securities.

A)Securities

Q13: When a stock offering is based on

Q14: When facilitating a secondary stock offering, a

Q15: After a target firm is acquired, the

Q16: _ is not a service that a

Q17: The price of newly issued stock should

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents