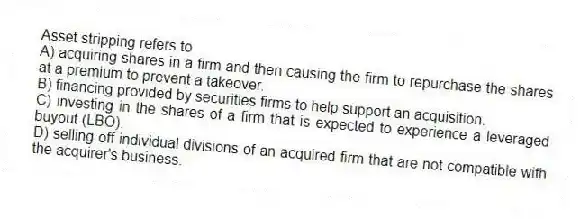

Asset stripping refers to

A) acquiring shares in a firm and then causing the firm to repurchase the shares at a premium to prevent a takeover.

B) financing provided by securities firms to help support an acquisition.

C) investing in the shares of a firm that is expected to experience a leveraged buyout (LBO) .

D) selling off individual divisions of an acquired firm that are not compatible with the acquirer's business.

Correct Answer:

Verified

Q1: The _ determines margin requirements on securities

Q2: The _ is not involved in the

Q3: The _ can liquidate failing brokerage firms.

A)Securities

Q3: Research indicates that securities firms tend to

A)

Q4: Competitive bidding by securities firms for underwriting

Q6: The value of a securities firm is

Q6: The one-day return to investors who purchase

Q9: In a _ of stock, all of

Q10: Which of the following is not a

Q13: When a stock offering is based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents