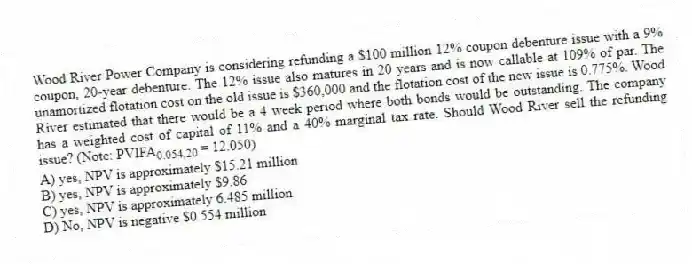

Wood River Power Company is considering refunding a $100 million 12% coupon debenture issue with a 9% coupon, 20-year debenture. The 12% issue also matures in 20 years and is now callable at 109% of par. The unamortized flotation cost on the old issue is $360,000 and the flotation cost of the new issue is 0.775%. Wood River estimated that there would be a 4 week period where both bonds would be outstanding. The company has a weighted cost of capital of 11% and a 40% marginal tax rate. Should Wood River sell the refunding issue? (Note: PVIFA0.054,20 = 12.050)

A) yes, NPV is approximately $15.21 million

B) yes, NPV is approximately $9.86

C) yes, NPV is approximately 6.485 million

D) No, NPV is negative $0.554 million

Correct Answer:

Verified

Q3: Cutech issued a $150 million of a

Q4: Midget Digit Toe Doctors is planning to

Q5: When considering bond refunding, all of the

Q5: If Alliant can issue a $110 million

Q6: Clinch River Power is considering refunding a

Q6: Demetres is refunding an outstanding $75 million,

Q7: Bond _ occurs when a firm exercises

Q10: Why is the after-tax cost of debt

Q11: In a bond refunding analysis, the principal

Q19: When a bond is called, the old

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents