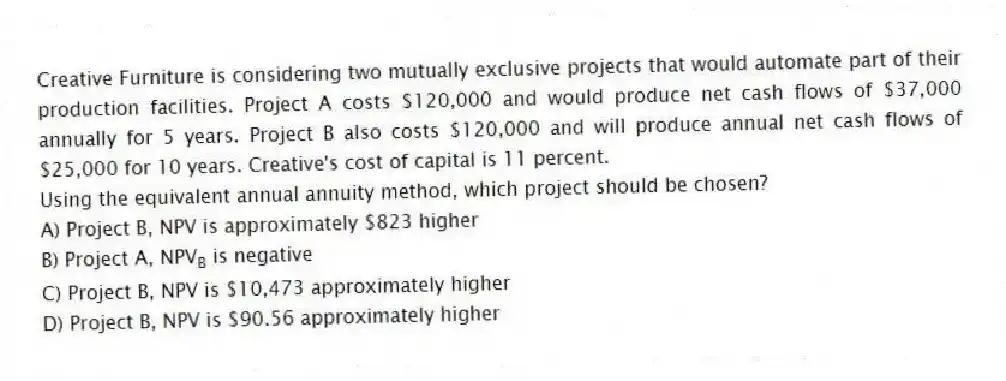

Creative Furniture is considering two mutually exclusive projects that would automate part of their production facilities. Project A costs $120,000 and would produce net cash flows of $37,000 annually for 5 years. Project B also costs $120,000 and will produce annual net cash flows of $25,000 for 10 years. Creative's cost of capital is 11 percent.

-Using the equivalent annual annuity method, which project should be chosen?

A) Project B, NPV is approximately $823 higher

B) Project A, NPVB is negative

C) Project B, NPV is $10,473 approximately higher

D) Project B, NPV is $90.56 approximately higher

Correct Answer:

Verified

Q5: Quorex is evaluating two mutually exclusive projects.Project

Q6: Lakeland Ramblers is considering two mutually exclusive

Q7: Under most conditions the equivalent annual annuity

Q13: Marvec needs to replace an extruder and

Q14: Casa Chica is considering replacing a piece

Q14: Rollerblade, a maker of skating gear, is

Q15: is (are) used when evaluating mutually exclusive

Q16: How does the equivalent annual annuity approach

Q17: When two or more mutually exclusive alternative

Q18: The importance of time discrepancies depends on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents