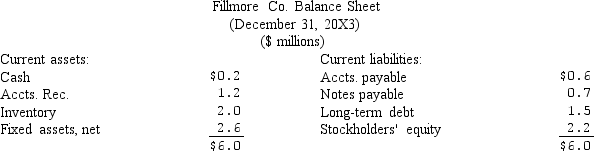

In 20X3, the Fillmore Company's sales were $12.0 million. Its balance sheet at year end 20X3 is shown below. Fillmore's 20X4 sales are expected to be $15 million and its 20X5 sales are expected to be $18 million. Earnings after tax in both years is expected to be 5.0% of sales, and annual dividends of $250,000 are expected to be paid in both 20X4 and 20X5. The company presently has excess plant and equipment capacity. As a result, assume that the net fixed asset figure on the balance sheet will remain constant for both 20X4 and 20X5. Assuming that the ratios of assets (except fixed assets, net) to sales and accounts payable to sales in 20X3 remain the same in 20X4 and 20X5, calculate the total amount, i.e., one number, of external financing required during the 2 year period from 20X4 through 20X5, using the percentage of sales method.

A) $ 750,000

B) $ 250,000

C) $1,000,000

D) None of the above

Correct Answer:

Verified

Q21: Calculate United's total assets if the firm

Q24: Getrag expects its sales to increase 20%

Q26: The Danville Company is considering a $50

Q35: In preparing a statement of cash flows,

Q37: Last year Curative Technologies Inc.reported earnings after-tax

Q37: Ship-to-Shore earned $280,000 after taxes last year.

Q38: The Financial Accounting Standard Board (FASB) requires

Q39: Scorch & Burn Fire Extinguishers, Inc. had

Q41: A good operational plan incorporates a plan

Q42: Which of the following statements is/are correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents