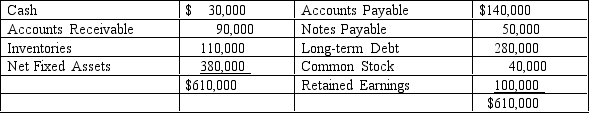

Lullaby Lane Bedding, Inc. needs to determine the amount of growth the firm could experience without having to obtain external financing. The current sales level is $800,000, the net profit margin is 6%, and the dividend payout ratio is 40%. Assume the firm is currently operating at full capacity and all assets will increase proportionately with sales. Lane's current balance sheet follows:

A) 6.53%

B) 1.09%

C) 11.97%

D) 13.50%

Correct Answer:

Verified

Q21: Calculate United's total assets if the firm

Q23: Great Subs believes it can increase sales

Q24: Getrag expects its sales to increase 20%

Q25: The Hudson River Line Company has a

Q25: The financial statement that shows the effects

Q27: Generally, which of the following non-cash charges

Q30: Which of the following shows the effects

Q31: After-tax cash flow equals _.

A) earnings after

Q36: Last year Molex's net cash provided by

Q37: Ship-to-Shore earned $280,000 after taxes last year.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents