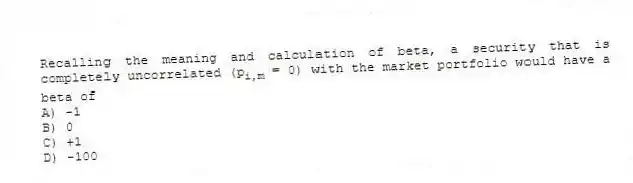

Recalling the meaning and calculation of beta, a security that is completely uncorrelated (pi,m = 0) with the market portfolio would have a beta of

A) -1

B) 0

C) +1

D) -100

Correct Answer:

Verified

Q2: The _ of a portfolio of two

Q2: Security A's expected return is 10 percent

Q4: The primary difference between the standard deviation

Q5: The coefficient of variation is a(n) measure

Q10: A beta value of 0.5 for a

Q10: Users of the CAPM should be aware

Q13: The _ the standard deviation, the _

Q13: The slope of the characteristic line for

Q16: The _ is a statistical measure of

Q20: All other things being equal, what is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents