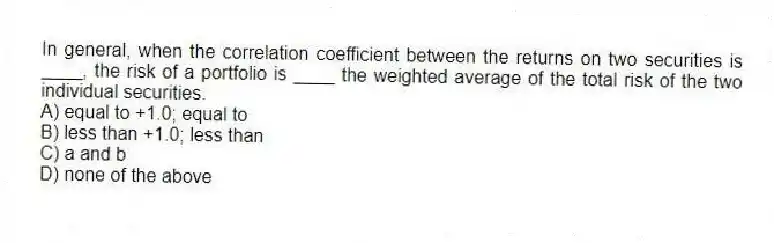

In general, when the correlation coefficient between the returns on two securities is ____, the risk of a portfolio is ____ the weighted average of the total risk of the two individual securities.

A) equal to +1.0; equal to

B) less than +1.0; less than

C) a and b

D) none of the above

Correct Answer:

Verified

Q21: The most relevant risk that must be

Q23: An increase in uncertainty regarding the future

Q26: The security returns from multinational companies tend

Q29: Which of the following (if any) is

Q32: In order to completely eliminate the risk

Q34: Investors generally are considered to be risk

Q35: Texas Computers (TC) stock has a beta

Q40: The risk-free rate of return can be

Q50: On the capital market line (CML), any

Q58: Business risk is influenced by all the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents