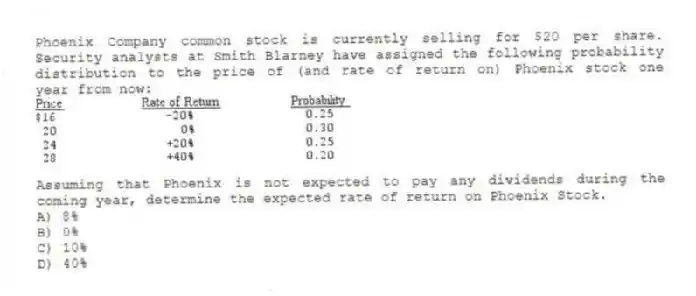

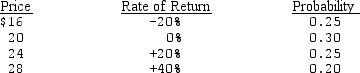

Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

A) 8%

B) 0%

C) 10%

D) 40%

Correct Answer:

Verified

Q21: The most relevant risk that must be

Q35: Texas Computers (TC) stock has a beta

Q43: Phoenix Company common stock is currently selling

Q45: The two elements that make up the

Q47: Phoenix Company common stock is currently selling

Q50: On the capital market line (CML), any

Q53: The term structure of interest rates is

Q53: According to the , long-term interest rates

Q58: Business risk is influenced by all the

Q59: refers to the ability of an investor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents