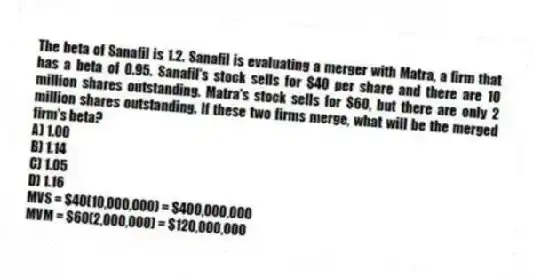

The beta of Sanafil is 1.2. Sanafil is evaluating a merger with Matra, a firm that has a beta of 0.95. Sanafil's stock sells for $40 per share and there are 10 million shares outstanding. Matra's stock sells for $60, but there are only 2 million shares outstanding. If these two firms merge, what will be the merged firm's beta?

A) 1.00

B) 1.14

C) 1.05

D) 1.16

MVS = $40(10,000,000) = $400,000,000

MVM = $60(2,000,000) = $120,000,000

Correct Answer:

Verified

Q84: Gates Industries current common stock dividend (year

Q93: Total risk of a security can be

Q96: Determine the beta of a portfolio consisting

Q97: Security A offers an expected return of

Q98: Kermit Industries' current common stock dividend is

Q99: Which of the following statements is/are correct?

I.

Q99: AKA's stock is currently selling for $11.44.This

Q103: What is an efficient portfolio?

Q108: List the various risk elements that are

Q114: An investor, by investing in combinations of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents