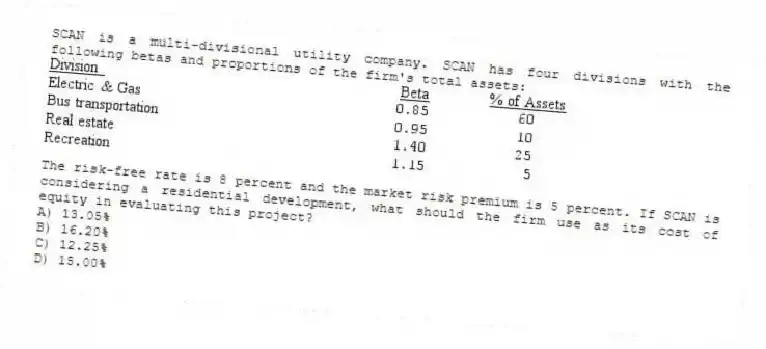

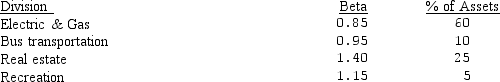

SCAN is a multi-divisional utility company. SCAN has four divisions with the following betas and proportions of the firm's total assets:

The risk-free rate is 8 percent and the market risk premium is 5 percent. If SCAN is considering a residential development, what should the firm use as its cost of equity in evaluating this project?

A) 13.05%

B) 16.20%

C) 12.25%

D) 15.00%

Correct Answer:

Verified

Q21: Technico plans to start a new product

Q21: The DMT Company is financed entirely with

Q22: The certainty equivalent factors used in capital

Q24: The _ approach is widely used by

Q27: When evaluating a capital expenditure to be

Q28: With the risk-adjusted discount rate approach, in

Q32: Faris currently has a capital structure of

Q33: The risk-adjusted discount rate approach is used

Q39: A simulation analysis for a new acquisition

Q39: Calco is a multi-divisional firm with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents