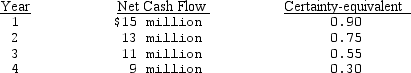

The Bull Company, a lawn mower manufacturer, is considering the introduction of a new model. The initial outlay required is $22 million. Net cash flows over the 4-year life cycle and the corresponding certainty-equivalents of the new model are as follows:

The firm's cost of capital is 14% and the risk-free rate is 6%. Bull uses the certainty-equivalent approach in evaluating above-average risk investments such as this one. What is the project's certainty-equivalent NPV?

A) $20,083,000

B) $ 6,628,400

C) $13,905,000

D) $ 3,019,400

Correct Answer:

Verified

Q29: With the _ approach, the decision maker

Q37: The of a firm is a weighted

Q37: The most expensive method of adjusting for

Q42: The type of analysis that models some

Q42: The Chris-Kraft Co.is financed entirely with equity

Q46: Many firms combine net present value and

Q48: M-tel is financed entirely with equity, and

Q48: Given the following cash flows and certainty

Q57: All of the following are correct statements

Q58: All of the following techniques are used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents