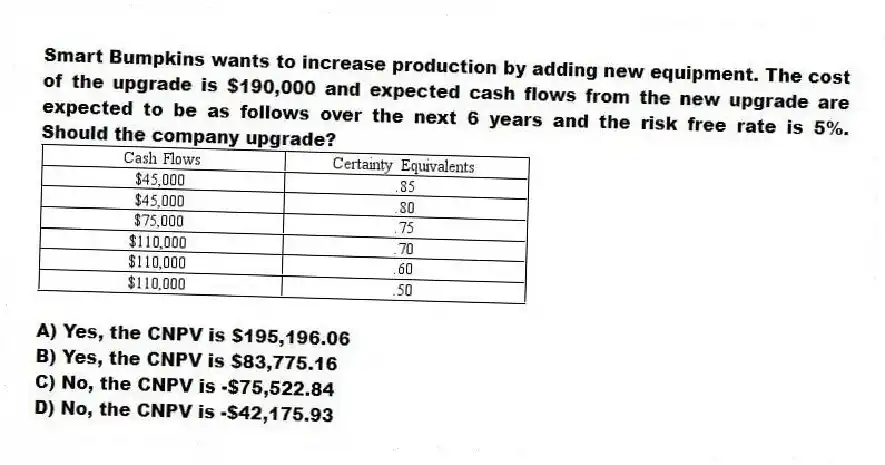

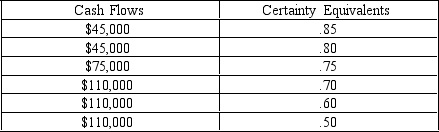

Smart Bumpkins wants to increase production by adding new equipment. The cost of the upgrade is $190,000 and expected cash flows from the new upgrade are expected to be as follows over the next 6 years and the risk free rate is 5%. Should the company upgrade?

A) Yes, the CNPV is $195,196.06

B) Yes, the CNPV is $83,775.16

C) No, the CNPV is -$75,522.84

D) No, the CNPV is -$42,175.93

Correct Answer:

Verified

Q47: A weakness of the net present value/payback

Q55: American Biodyne (AB) is considering expanding into

Q62: How can beta, a measure of systematic

Q62: are needed for sensitivity analysis and have

Q63: List the ways that a company's decision

Q66: What item has made sensitivity analysis simple

Q72: All of the following are methods of

Q75: The hurdle rate approach in determining the

Q77: Determine the pure project beta of a

Q78: Determine the pure project beta of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents