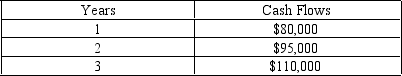

Haulin'It Towing Company is considering adding more tow trucks to its fleet. The cost of the new trucks is $150,000. The project will utilize the risk adjusted discount, the firm has a beta of 1.3, the risk free rate is 7% and the return in the market is 15%. Should Haulin' It add the additional trucks if the expected increased revenues will be as follows?

A) No, the npv of the project is -$15,175.19

B) Yes, the npv of the project is $75,275.16

C) No, the npv of the project is -$9,765.12

D) Yes, the npv of the project is $55,050.92

Correct Answer:

Verified

Q62: are needed for sensitivity analysis and have

Q63: When is the risk-adjusted discount rate approach

Q66: What item has made sensitivity analysis simple

Q69: The risk of an investment project is

Q70: What are the primary advantages and disadvantages

Q71: How and when should firms consider employing

Q72: All of the following are methods of

Q75: The hurdle rate approach in determining the

Q76: What are the weaknesses of the net

Q76: Which of the following is/are a risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents