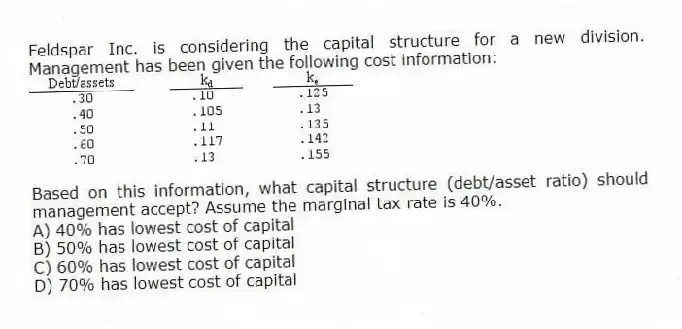

Feldspar Inc. is considering the capital structure for a new division. Management has been given the following cost information:

Based on this information, what capital structure (debt/asset ratio) should management accept? Assume the marginal tax rate is 40%.

A) 40% has lowest cost of capital

B) 50% has lowest cost of capital

C) 60% has lowest cost of capital

D) 70% has lowest cost of capital

Correct Answer:

Verified

Q30: The market value of a levered firm

Q32: The management of Graphicopy is trying to

Q38: The less a firm's business risk, the

Q39: Agency costs _.

A) increase as the debt/total

Q41: Triad Labs has total assets of $120

Q47: Calculate the market value of Lotle Group,

Q48: Calculate the market value of a firm

Q49: What is the annual tax shield to

Q51: What is the present value of the

Q51: RoTek has a capital structure of $300,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents