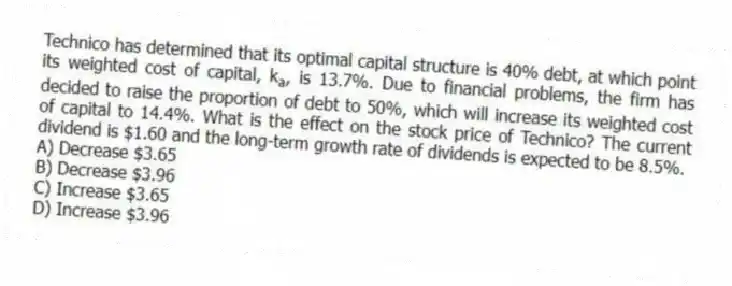

Technico has determined that its optimal capital structure is 40% debt, at which point its weighted cost of capital, ka, is 13.7%. Due to financial problems, the firm has decided to raise the proportion of debt to 50%, which will increase its weighted cost of capital to 14.4%. What is the effect on the stock price of Technico? The current dividend is $1.60 and the long-term growth rate of dividends is expected to be 8.5%.

A) Decrease $3.65

B) Decrease $3.96

C) Increase $3.65

D) Increase $3.96

Correct Answer:

Verified

Q43: The airline industry is extremely price competitive,

Q46: What is the present value of the

Q47: Calculate the market value of Lotle Group,

Q50: Calculate the market value of a firm

Q51: RoTek has a capital structure of $300,000

Q52: The greater the variability of costs, the

Q52: The capital structure decision attempts to minimize

Q53: Seduak has estimated the costs of debt

Q56: Arbitrage transactions are _.

A) risky

B) illegal

C) speculative

D)

Q57: What is the annual tax shield to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents