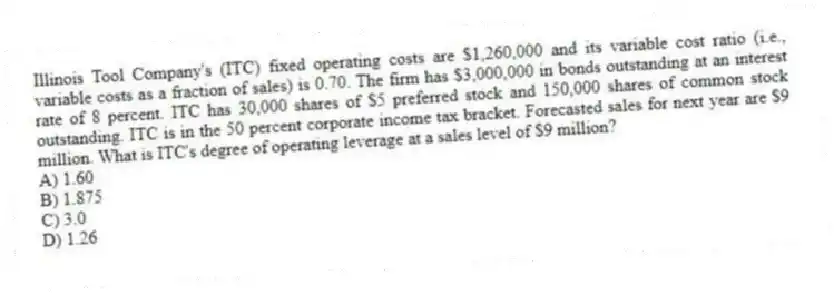

Illinois Tool Company's (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70. The firm has $3,000,000 in bonds outstanding at an interest rate of 8 percent. ITC has 30,000 shares of $5 preferred stock and 150,000 shares of common stock outstanding. ITC is in the 50 percent corporate income tax bracket. Forecasted sales for next year are $9 million. What is ITC's degree of operating leverage at a sales level of $9 million?

A) 1.60

B) 1.875

C) 3.0

D) 1.26

Correct Answer:

Verified

Q21: Kermit's Hardware's (KH) fixed operating costs are

Q34: The use of increasing amounts of combined

Q35: Illinois Tool Company's (ITC) fixed operating costs

Q36: A negative DOL indicates the percentage _

Q38: Kermit's Hardware's (KH) fixed operating costs are

Q40: Suppose that ITC's degree of combined leverage

Q41: Higgins currently has 2 million shares of

Q41: Onyx expects to have an EBIT of

Q42: The Ames Company has an expected EBIT

Q58: Sulzar's capital structure consists only of common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents