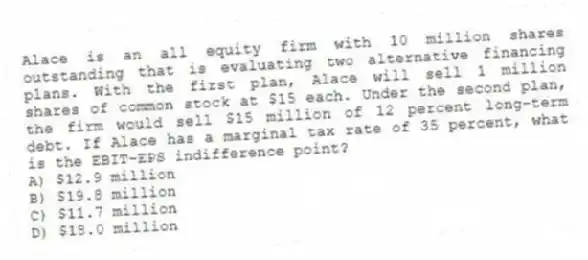

Alace is an all equity firm with 10 million shares outstanding that is evaluating two alternative financing plans. With the first plan, Alace will sell 1 million shares of common stock at $15 each. Under the second plan, the firm would sell $15 million of 12 percent long-term debt. If Alace has a marginal tax rate of 35 percent, what is the EBIT-EPS indifference point?

A) $12.9 million

B) $19.8 million

C) $11.7 million

D) $18.0 million

Correct Answer:

Verified

Q40: Suppose that ITC's degree of combined leverage

Q41: Onyx expects to have an EBIT of

Q41: Higgins currently has 2 million shares of

Q42: The Ames Company has an expected EBIT

Q42: Onex expects to have an EBIT of

Q49: Two companies, Jefferson and Jackson, are virtually

Q50: Given the following financial data for Boston

Q53: ASG expects next year's operating income (EBIT)

Q56: Centex, a producer of telephone systems for

Q58: Sulzar's capital structure consists only of common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents