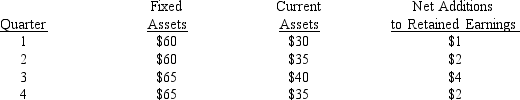

Barnes Company has highly seasonal sales and financing requirements. Barnes has made the following projections of its asset needs and net additions to retained earnings over the next year (in $ million) .

Net worth (equity) at the beginning of the year is $50 million. The company does not plan to sell any new equity during the coming year. Assume that Barnes follows a matching approach to finance its assets, i.e., long-term debt and equity are used to finance fixed and permanent current assets and short-term debt is used to finance fluctuating current assets. Determine the amount of long-term and short-term debt respectively outstanding at the end of the third quarter ($ million) .

A) $39; $2

B) $48; $0

C) $41; $7

D) none of the above/cannot be determined

Correct Answer:

Verified

Q50: What is the inventory conversion period for

Q50: Simmons Industries is considering two alternative working

Q53: Laserscope has an inventory conversion period of

Q54: Cisco Systems wishes to analyze the joint

Q56: Laserscope Inc. is trying to determine the

Q57: If Swatch's inventory conversion period is 45

Q69: Firms can meet its financing needs by

Q72: What are accrued expenses and how are

Q76: Negotiated short-term credit sources are all of

Q76: Explain how a firm uses commercial paper

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents