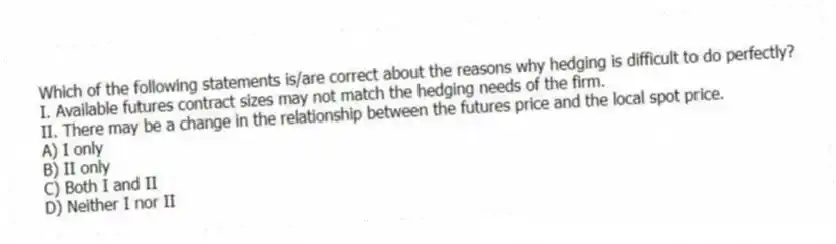

Which of the following statements is/are correct about the reasons why hedging is difficult to do perfectly?

I. Available futures contract sizes may not match the hedging needs of the firm.

II. There may be a change in the relationship between the futures price and the local spot price.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

Correct Answer:

Verified

Q8: Forward contracts are most common in _

Q21: In the futures market, losers must pay

Q21: Acquisition of additional information can be accomplished

Q22: Forward contracts are said to possess risk.

A)business

Q29: Marking to market is a procedure for

Q31: Which of the following is the most

Q32: Financial derivatives can be used to manage

Q32: Which of the following is a facilitator

Q36: Which of the following statements is/are true

Q37: Which of the following statements about risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents