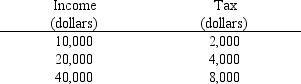

Use the table below to choose the correct answer.

The tax schedule shown here is

A) regressive.

B) proportional.

C) progressive.

D) proportional up to $20,000 and regressive beyond that.

Correct Answer:

Verified

Q103: A subsidy is defined as

A) a payment

Q107: A payment the government makes to either

Q108: In the supply and demand model, a

Q118: A $25 government subsidy paid directly to

Q121: Suppose that the federal government grants a

Q144: The Laffer curve indicates that

A) when tax

Q162: When the top marginal tax rates were

Q167: Approximately 50,000 luxury boats (priced $100,000 or

Q169: Suppose the federal excise tax rate on

Q178: Use the table below to choose the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents