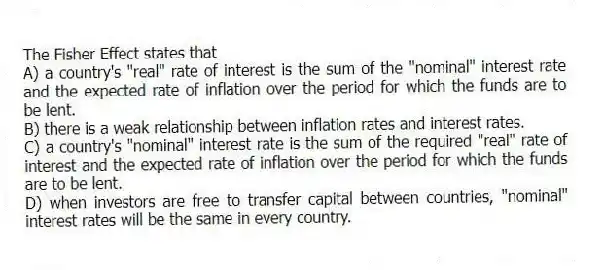

The Fisher Effect states that

A) a country's "real" rate of interest is the sum of the "nominal" interest rate and the expected rate of inflation over the period for which the funds are to be lent.

B) there is a weak relationship between inflation rates and interest rates.

C) a country's "nominal" interest rate is the sum of the required "real" rate of interest and the expected rate of inflation over the period for which the funds are to be lent.

D) when investors are free to transfer capital between countries, "nominal" interest rates will be the same in every country.

Correct Answer:

Verified

Q38: The rate at which one currency is

Q39: When two parties agree to exchange currency

Q40: _ are reported on a real-time basis

Q41: The foreign exchange market is

A) open for

Q42: Assume that the yen/dollar exchange rate quoted

Q44: Assuming the 30-day forward exchange rate was

Q45: When two parties agree to exchange currency

Q46: The International Fisher Effect has

A) proven to

Q47: The purchasing power parity (PPP) theory tells

Q48: The _ is a global network of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents