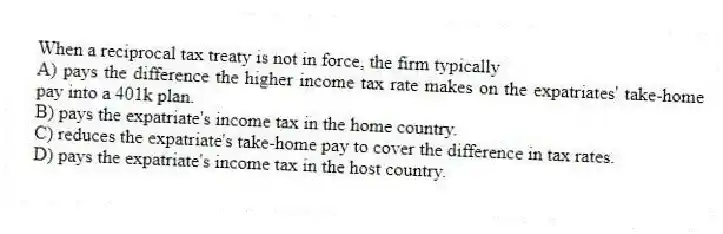

When a reciprocal tax treaty is not in force, the firm typically

A) pays the difference the higher income tax rate makes on the expatriates' take-home pay into a 401k plan.

B) pays the expatriate's income tax in the home country.

C) reduces the expatriate's take-home pay to cover the difference in tax rates.

D) pays the expatriate's income tax in the host country.

Correct Answer:

Verified

Q89: If a firm is serious about building

Q90: A _ may be paid to ensure

Q91: A foreign service premium is

A) paid when

Q92: Which of the following is an action

Q93: What was the long-term goal of international

Q95: The international trade secretariats (ITS) have had

Q96: What are the three types of staffing

Q97: Which of the following is true regarding

Q98: Discuss the advantages and disadvantages of a

Q99: What is human resource management? Why is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents