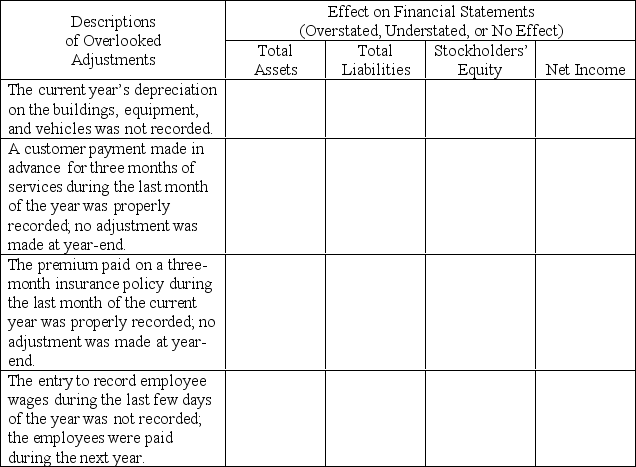

Assume that the accountant neglected to analyze the company's accounts and did not prepare any adjusting entries at the end of the year.The adjusting entries that should have been made are described in the table below.

Required:

For each overlooked adjusting entry,indicate how each error impacted the amounts of total assets,total liabilities,and total stockholders' equity that were reported on the balance sheet and the amount of net income reported on the income statement.

Correct Answer:

Verified

Q226: Which of the following will happen if

Q236: All of the accounts of the Grass

Q237: Oklahoma Company has a fiscal year ending

Q239: The following account balances are included in

Q240: When it paid its rent in advance,a

Q242: Listed below are the account balances that

Q243: Match the term and its definition.There are

Q244: A new Chief Executive Officer (CEO)was hired

Q245: The alphabetical listing below includes all of

Q246: Match each transaction with the type of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents