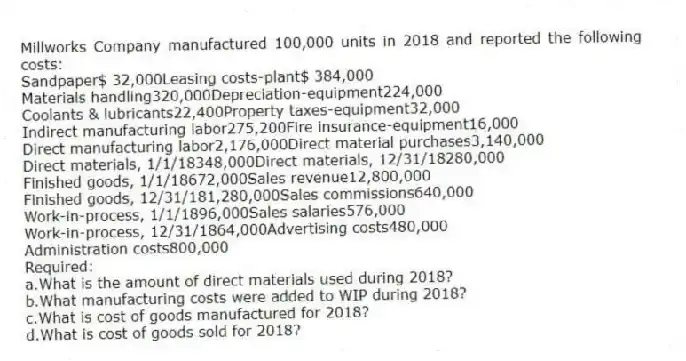

Millworks Company manufactured 100,000 units in 2018 and reported the following costs:

Sandpaper$ 32,000Leasing costs-plant$ 384,000

Materials handling320,000Depreciation-equipment224,000

Coolants & lubricants22,400Property taxes-equipment32,000

Indirect manufacturing labor275,200Fire insurance-equipment16,000

Direct manufacturing labor2,176,000Direct material purchases3,140,000

Direct materials, 1/1/18348,000Direct materials, 12/31/18280,000

Finished goods, 1/1/18672,000Sales revenue12,800,000

Finished goods, 12/31/181,280,000Sales commissions640,000

Work-in-process, 1/1/1896,000Sales salaries576,000

Work-in-process, 12/31/1864,000Advertising costs480,000

Administration costs800,000

Required:

a.What is the amount of direct materials used during 2018?

b.What manufacturing costs were added to WIP during 2018?

c.What is cost of goods manufactured for 2018?

d.What is cost of goods sold for 2018?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q173: For last year, Watson Limited reported revenues

Q174: All Rite Manufacturing reported the following:

Q175: Total manufacturing costs equal _.

A) direct materials

Q176: The following information pertains to the Ruby

Q177: What is the cost of goods manufactured

Q179: Which of the following formulas determine cost

Q180: Product costs for financial statements are:

A) inventoriable

Q181: A company reported revenues of $382,000, cost

Q182: U.S. Systems Inc., had the following activities

Q183: Operating income is sales revenue minus operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents