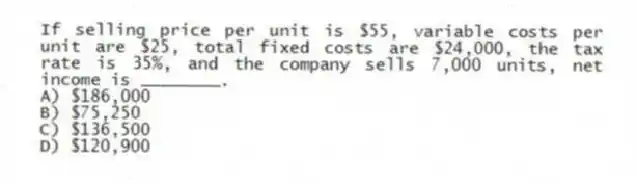

If selling price per unit is $55, variable costs per unit are $25, total fixed costs are $24,000, the tax rate is 35%, and the company sells 7,000 units, net income is ________.

A) $186,000

B) $75,250

C) $136,500

D) $120,900

Correct Answer:

Verified

Q103: The Marietta Company has fixed costs of

Q104: Tony Manufacturing produces a single product that

Q105: Tony Manufacturing produces a single product that

Q106: All else being constant, an increase in

Q107: If a company is planning to reduce

Q109: An increase in the tax rate will

Q110: All else being equal, a reduction in

Q111: If planned net income is $30,000 and

Q112: Assume only the specified parameters change in

Q113: A firm operating at breakeven point will

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents