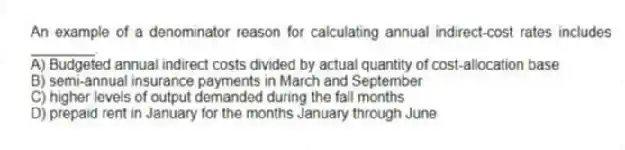

An example of a denominator reason for calculating annual indirect-cost rates includes ________.

A) Budgeted annual indirect costs divided by actual quantity of cost-allocation base

B) semi-annual insurance payments in March and September

C) higher levels of output demanded during the fall months

D) prepaid rent in January for the months January through June

Correct Answer:

Verified

Q22: Process costing is used to assign manufacturing

Q23: Oil refining companies primarily use job costing

Q24: Which of the following are reasons for

Q25: Whether a company chooses to use either

Q26: Job costing _.

A) cannot be used by

Q28: Which of the following companies will use

Q29: In each period, job costing divides the

Q30: Describe job-costing and process-costing systems. Explain when

Q31: When calculating indirect cost rates, the longer

Q32: Job-costing is likely to be used by_.

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents