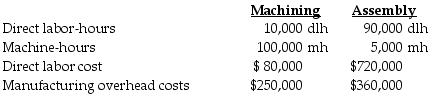

Hill Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products. Manufacturing overhead costs are applied on the basis of machine-hours in the Machining Department and on the basis of direct labor-hours in the Assembly Department. At the beginning of 2018, the following estimates were provided for the coming year:

The accounting records of the company show the following data for Job #846:

Required:

a.Compute the manufacturing overhead allocation rate for each department.

b.Compute the total cost of Job #846.

c.Provide possible reasons why Hill Manufacturing uses two different cost allocation rates.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: The budgeted indirect cost rate is actual

Q116: The Materials Control account is increased when

Q117: When $10,0000 direct materials are requisitioned, which

Q118: Chief Manufacturing is a small textile manufacturer

Q119: For externally reported inventory costs, the Work-in-Process

Q121: Which account would be credited if the

Q122: Franklin Inc. manufactures pipes and applies manufacturing

Q123: River Falls Manufacturing uses a normal cost

Q124: When a job is complete _.

A) actual

Q125: Beta Corporation uses a job cost system

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents