The Robinson Corporation manufactures automobile parts. During the year, the company sold $5,600,000 of parts that had a cost of $3,200,000. At year end, these are the balances for cost of goods sold and its manufacturing overhead accounts:

Cost of goods sold $3,200,000

Manufacturing overhead allocated $1,400,000

Manufacturing overhead control $1,495,000

What would be the correct journal entry to close out the overhead accounts assuming that the write-of to cost of goods sold approach is used?

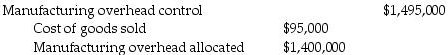

A)

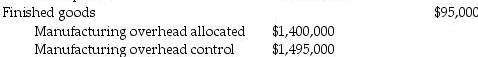

B)

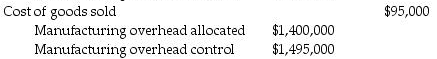

C)

D)

Correct Answer:

Verified

Q166: Financial Planning Partners Inc., employs 12 full-time

Q167: ABC Manufacturing Inc. ends the month with

Q168: The adjusted-allocation rate approach offers the benefit

Q169: ABC Manufacturing Inc. ends the month with

Q170: A company would use multiple cost-allocation bases

Q172: Innovative Metal Products Company manufactures pipes and

Q173: The approach often used when dealing with

Q174: The actual costs of all individual overhead

Q175: The _ adjusts individual job-cost records to

Q176: Management wants to prepare a profitability analysis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents