Jacobs Company manufactures refrigerators. The company uses a budgeted indirect-cost rate for its manufacturing operations and during 2018 allocated $1,000,000 to work-in-process inventory. Actual overhead incurred was $1,100,000.

Required:

a.Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold. Be sure your journal entry closes the related overhead accounts.

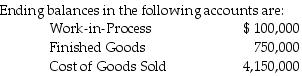

b.Prepare a journal entry that prorates the write-off of the difference between allocated and actual overhead using ending account balances. Be sure your journal entry closes the related overhead accounts.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q159: What are three possible ways to dispose

Q193: A local accounting firm employs 28 full-time

Q194: Moira Company has just finished its first

Q195: In the service sector, to achieve timely

Q196: In the service sector _.

A) direct labor

Q199: Hammond and Jarrett provide tax consulting for

Q200: Sedgwick County Hospital uses an indirect job-costing

Q201: A local CPA employs ten full-time professionals.

Q202: A local engineering firm is bidding on

Q203: An accounting firm completes an audit for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents