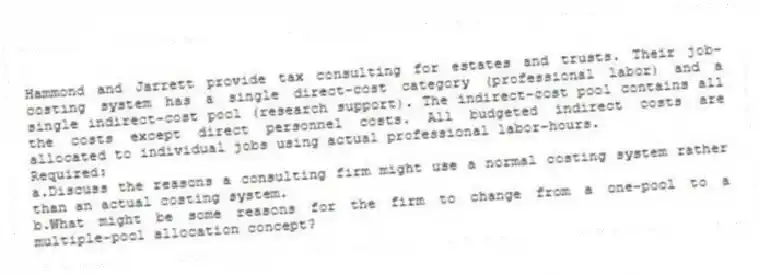

Hammond and Jarrett provide tax consulting for estates and trusts. Their job-costing system has a single direct-cost category (professional labor) and a single indirect-cost pool (research support). The indirect-cost pool contains all the costs except direct personnel costs. All budgeted indirect costs are allocated to individual jobs using actual professional labor-hours.

Required:

a.Discuss the reasons a consulting firm might use a normal costing system rather than an actual costing system.

b.What might be some reasons for the firm to change from a one-pool to a multiple-pool allocation concept?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q159: What are three possible ways to dispose

Q193: A local accounting firm employs 28 full-time

Q194: Moira Company has just finished its first

Q195: In the service sector, to achieve timely

Q196: In the service sector _.

A) direct labor

Q198: Jacobs Company manufactures refrigerators. The company uses

Q200: Sedgwick County Hospital uses an indirect job-costing

Q201: A local CPA employs ten full-time professionals.

Q202: A local engineering firm is bidding on

Q203: An accounting firm completes an audit for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents