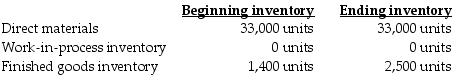

First Class, Inc., expects to sell 22,000 pool cues for $12 each. Direct materials costs are $3, direct manufacturing labor is $4, and manufacturing overhead is $0.84 per pool cue. The following inventory levels apply to 2019:

On the 2019 budgeted income statement, what amount will be reported for sales?

A) $277,200

B) $264,000

C) $396,000

D) $409,200

Correct Answer:

Verified

Q69: First Class, Inc., expects to sell 26,000

Q70: The following information pertains to the January

Q71: The following information pertains to the January

Q72: First Class, Inc., expects to sell 29,000

Q73: Which of the following is most likely

Q75: Which of the following best describes a

Q76: Tiger Pride produces two product lines: T-shirts

Q77: Mary's Baskets Company expects to manufacture and

Q78: Which of the following is required to

Q79: Orange Corporation has budgeted sales of 23,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents