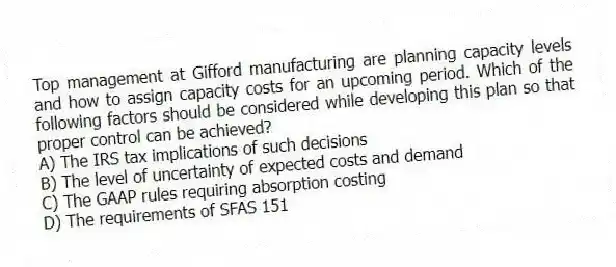

Top management at Gifford manufacturing are planning capacity levels and how to assign capacity costs for an upcoming period. Which of the following factors should be considered while developing this plan so that proper control can be achieved?

A) The IRS tax implications of such decisions

B) The level of uncertainty of expected costs and demand

C) The GAAP rules requiring absorption costing

D) The requirements of SFAS 151

Correct Answer:

Verified

Q186: Cape Cod Technolgy Inc. manufactures heavy duty

Q187: The only real challenge in planning and

Q188: If activity based cost accounting is used

Q189: How does the capacity level chosen to

Q190: Ms. Sophia Jones, the company president, has

Q192: Ms. Sophia Jones, the company president, has

Q193: Usually there is no production-volume variance when

Q194: Explain how using master-budget capacity utilization for

Q195: When actual production is below practical capacity,

Q196: The amount of fixed manufacturing costs inventoried

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents