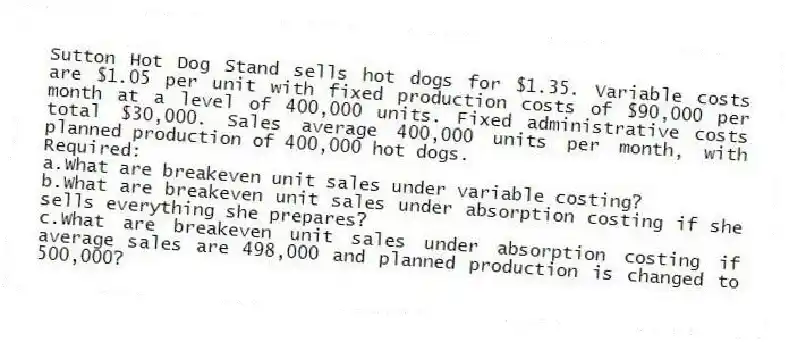

Sutton Hot Dog Stand sells hot dogs for $1.35. Variable costs are $1.05 per unit with fixed production costs of $90,000 per month at a level of 400,000 units. Fixed administrative costs total $30,000. Sales average 400,000 units per month, with planned production of 400,000 hot dogs.

Required:

a.What are breakeven unit sales under variable costing?

b.What are breakeven unit sales under absorption costing if she sells everything she prepares?

c.What are breakeven unit sales under absorption costing if average sales are 498,000 and planned production is changed to 500,000?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q200: Henry Chapman Manufacturing Inc. incurred the following

Q201: Patota Manufacturing incurred the following expenses during

Q202: Jenkins Corporation sells one product. The following

Q203: The breakeven points are the same under

Q204: Ms. Sophia Jones, the company president, has

Q205: Jenkins Corporation sells one product. The following

Q207: Francis Corporation is having trouble selling its

Q208: Banta Corporation is in the business of

Q209: Henry Chapman Manufacturing Inc. incurred the following

Q210: Match each of the following items with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents