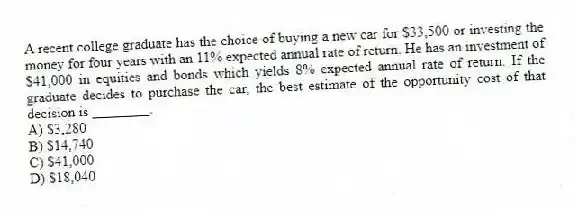

A recent college graduate has the choice of buying a new car for $33,500 or investing the money for four years with an 11% expected annual rate of return. He has an investment of $41,000 in equities and bonds which yields 8% expected annual rate of return. If the graduate decides to purchase the car, the best estimate of the opportunity cost of that decision is ________.

A) $3,280

B) $14,740

C) $41,000

D) $18,040

Correct Answer:

Verified

Q105: A supplier offers to make Part A

Q106: A study by a consultant shows that

Q107: Opportunity costs are not recorded in financial

Q108: Which of the following would be a

Q109: Rubium Micro Devices currently manufactures a subassembly

Q111: Which of the following is true of

Q112: For decision making, differential costs assist in

Q113: If a company does not use one

Q114: W.T. Ginsburg Engine Company manufactures part ACT30107

Q115: Which of the following would be considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents