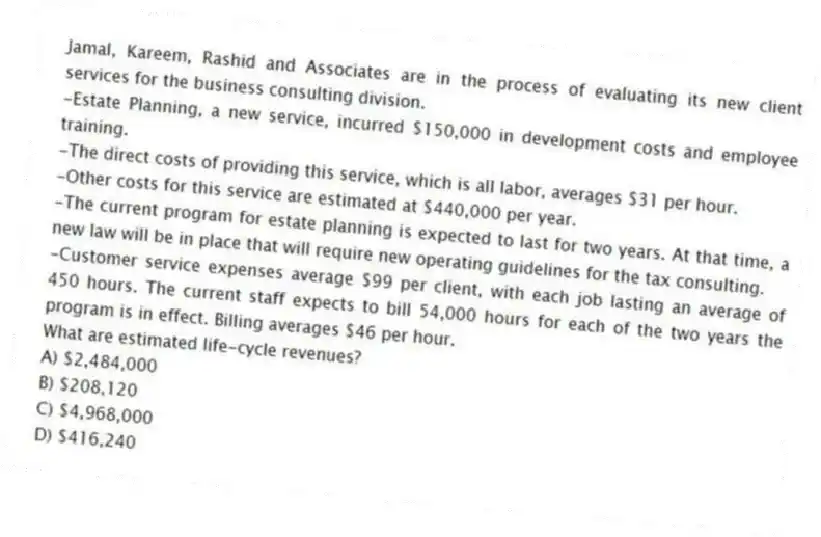

Jamal, Kareem, Rashid and Associates are in the process of evaluating its new client services for the business consulting division.

-Estate Planning, a new service, incurred $150,000 in development costs and employee training.

-The direct costs of providing this service, which is all labor, averages $31 per hour.

-Other costs for this service are estimated at $440,000 per year.

-The current program for estate planning is expected to last for two years. At that time, a new law will be in place that will require new operating guidelines for the tax consulting.

-Customer service expenses average $99 per client, with each job lasting an average of 450 hours. The current staff expects to bill 54,000 hours for each of the two years the program is in effect. Billing averages $46 per hour.

What are estimated life-cycle revenues?

A) $2,484,000

B) $208,120

C) $4,968,000

D) $416,240

Correct Answer:

Verified

Q162: Knowledge Transfer Associates is in the process

Q163: Knowledge Transfer Associates is in the process

Q164: Expo Manufacturing Inc., is in the process

Q165: Jamal, Kareem, Rashid and Associates are in

Q166: Managing environmental costs is an example of

Q168: Expo Manufacturing Inc., is in the process

Q169: A life-cycle budget is usually prepared to

Q170: Grace Greeting Cards Incorporated is starting a

Q171: Franklin Company is in the process of

Q172: Which of the following is the best

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents